How to Calculate Payroll Without Excel

Managing payroll is a critical yet complex task for businesses, especially in Myanmar, where compliance with local labor laws and regulations is essential. Traditionally, many companies have relied on Excel spreadsheets for payroll calculations. While Excel is a powerful tool, it often presents challenges such as manual data entry errors, time-consuming processes, and difficulties in managing compliance with ever-changing tax laws. These issues can lead to inaccuracies in employee compensation and potential legal complications.

Challenges of Using Excel for Payroll in Myanmar

Excel-based payroll processing comes with multiple challenges, including error-prone manual data entry, which increases the risk of miscalculations. Managing payroll for a large workforce requires complex formulas and extensive datasets, making the process time-consuming and inefficient. Additionally, Myanmar’s evolving payroll regulations, such as income tax Myanmar Income Tax Calculation and Social Security Board (SSB) contributions About SSB necessitate constant formula updates, increasing the risk of non-compliance. Furthermore, Excel lacks robust security measures, leaving sensitive employee information vulnerable to unauthorized access or data loss.

Transitioning to Automated Payroll Solutions

To overcome these challenges, businesses are increasingly adopting automated payroll systems that streamline the entire process, ensuring accuracy, compliance, and efficiency. One such solution tailored for the Myanmar market is Better HR, a comprehensive cloud-based HR, Payroll & Recruitment software.

Advantages of Using Better HR for Payroll Processing

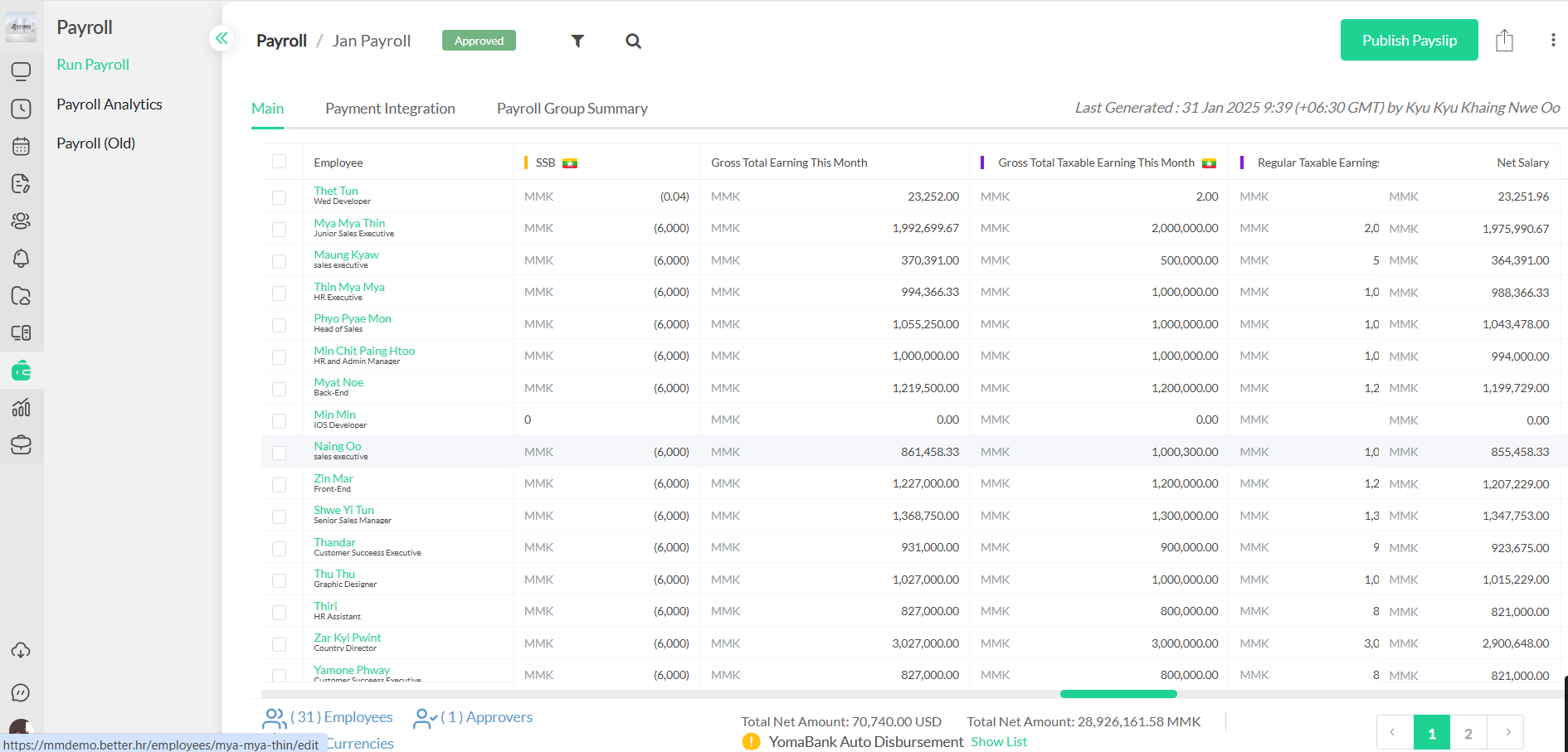

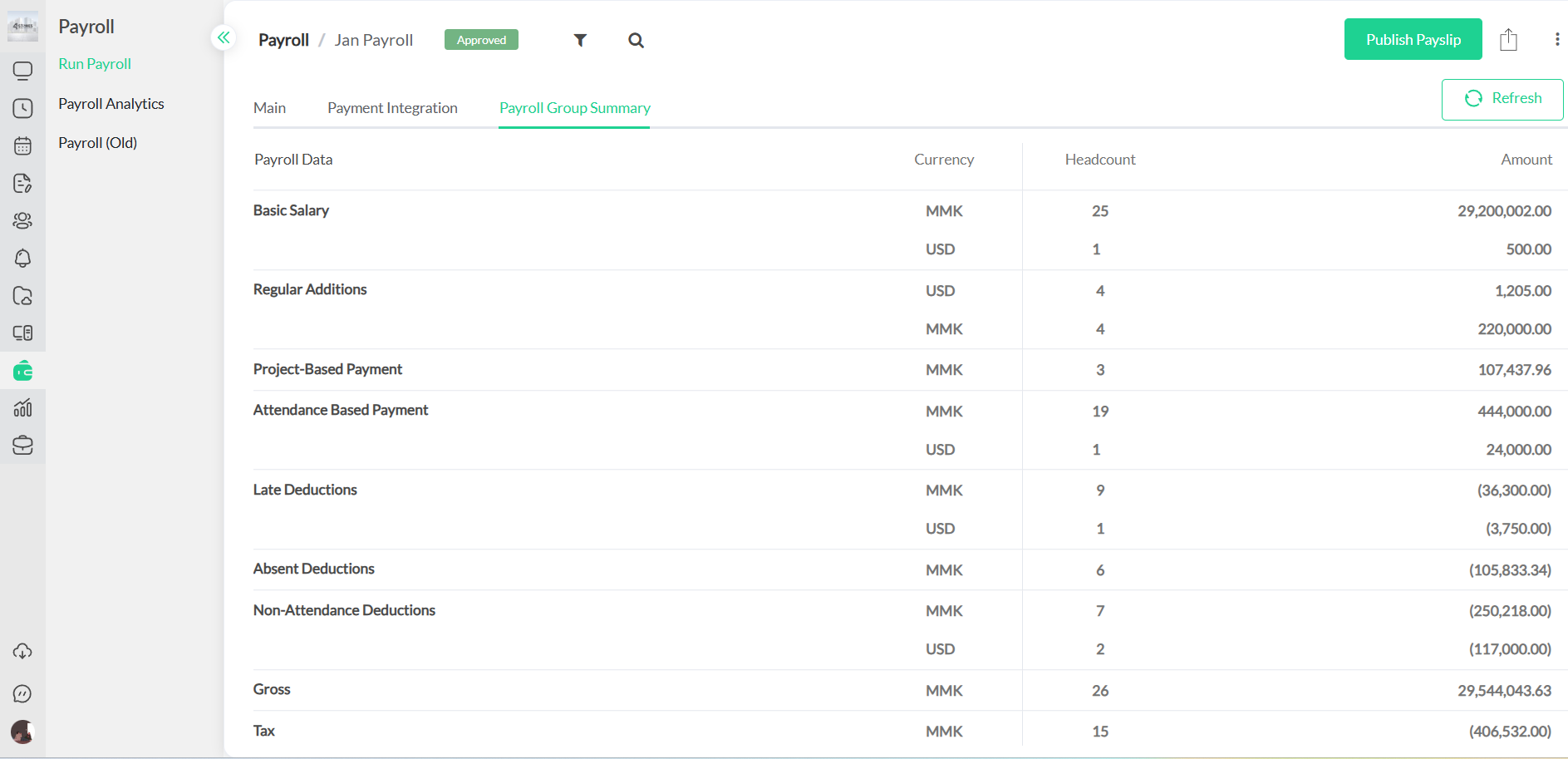

Automated Calculations: Better HR automates payroll calculations, including allowances, deductions, income tax, and SSB contributions, reducing the risk of human error and ensuring compliance with local regulations.

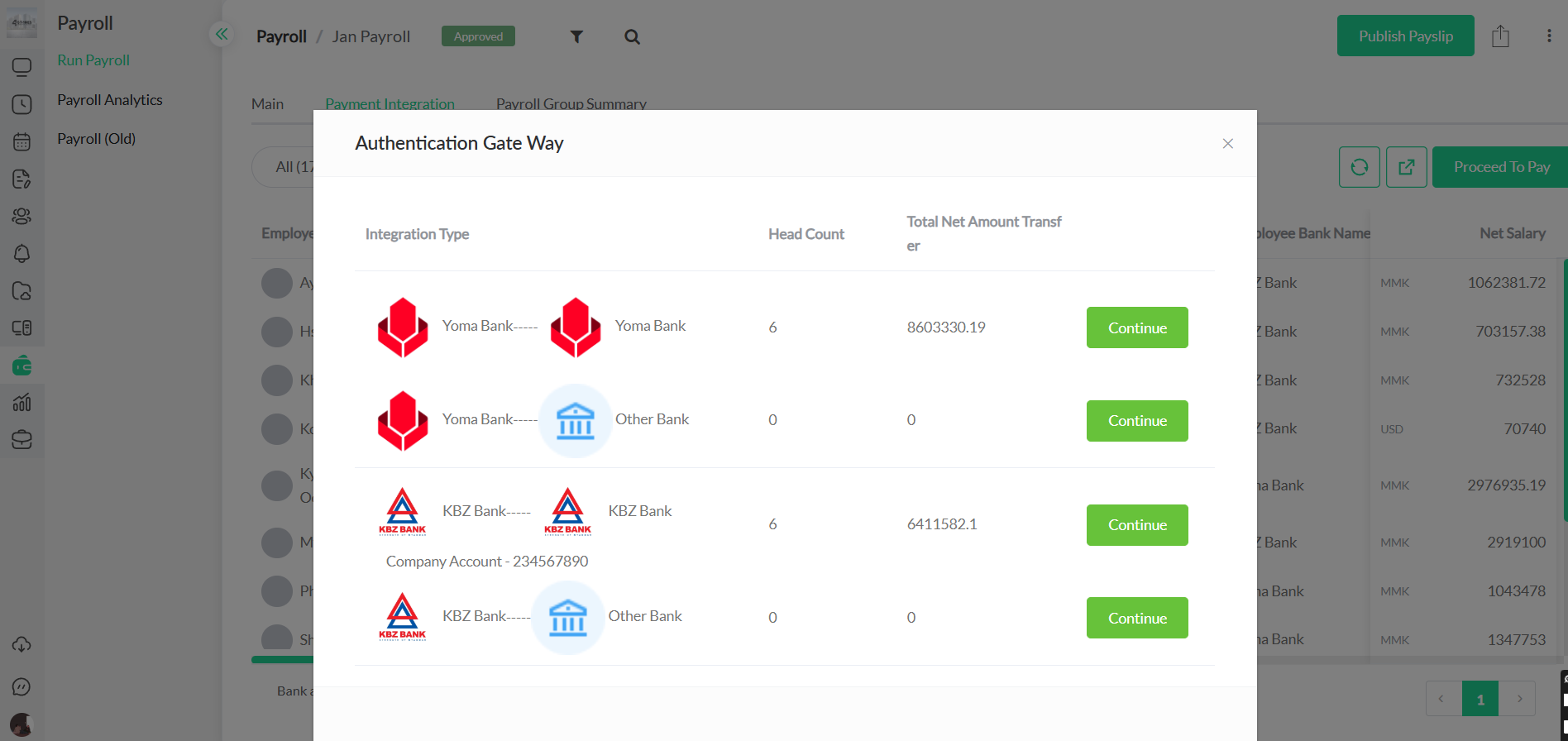

Direct Bank Integrations: The software integrates seamlessly with major Myanmar banks such as Yoma Bank, KBZ Bank, and UAB Bank, enabling direct salary disbursements to employees’ accounts. This integration simplifies the payment process and reduces administrative workload.

Real-Time Data Access: Being a cloud-based platform, Better HR provides real-time access to payroll data, allowing HR teams to monitor and manage payroll operations from anywhere, enhancing flexibility and responsiveness.

Enhanced Security: The system offers robust security features to protect sensitive employee information, ensuring data privacy and compliance with data protection standards.

Comprehensive HR Management: Beyond payroll, Better HR encompasses various HR functions, including attendance tracking, leave management, performance appraisals, and recruitment, providing an all-in-one solution for HR needs.

Transitioning from Excel-based payroll processing to an automated system like Better HR can significantly enhance the efficiency and accuracy of payroll management in Myanmar. By addressing the common pain points associated with manual payroll calculations, businesses can ensure compliance, reduce administrative burdens, and focus more on strategic initiatives. Embracing such technology not only streamlines operations but also contributes to overall organizational growth and employee satisfaction.Download all files